Rental properties vs. stocks – Which option is better?

There’s no doubt that the Stock Market has seen quite a decline recently as it’s lost roughly $4 trillion in value. These losses have led many investors to once again address the question of is the stock market the best market for investors or are rental properties the best investment?

Stocks Vs. Real Estate – Which Option Is Better?

(1) Buying a Rental Property vs. Stocks – Cash Flow and Total Return

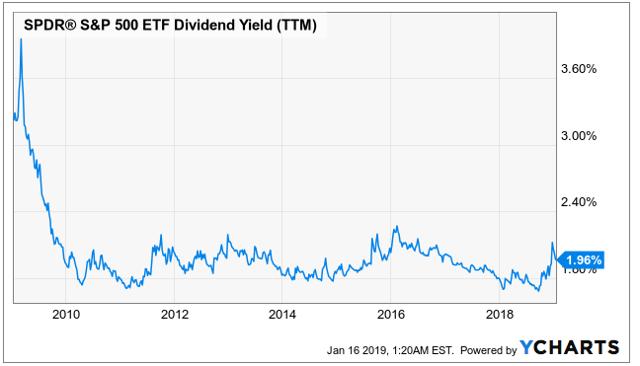

Generally speaking, stocks pay relatively little in cash flow (or dividends) to shareholders and generate the majority of their returns from capital appreciation. This is particularly true today as the S&P 500 (SPY) trades at a historically low dividend yield of just 1.96%:

Nonetheless, stocks have averaged total returns of right around 10% per year since 1928; so clearly, a low dividend yield does not tell the full story.

Rental properties, on the other hand, are famous for generating a larger chunk of their total return from cash flow. Tenants pay rents on a monthly basis, and this rent may account for an unleveraged return of 5-10% depending on the acquisition price of the property. The cash flow yields can greatly vary on the quality of the property and its location, but, more commonly, investors will target rentals with above average yields (or cap rates) to have ample liquidity to cover their mortgage, maintenance, build cash reserves for vacancies, and still earn an adequate return. But this is not all… properties appreciate over time…

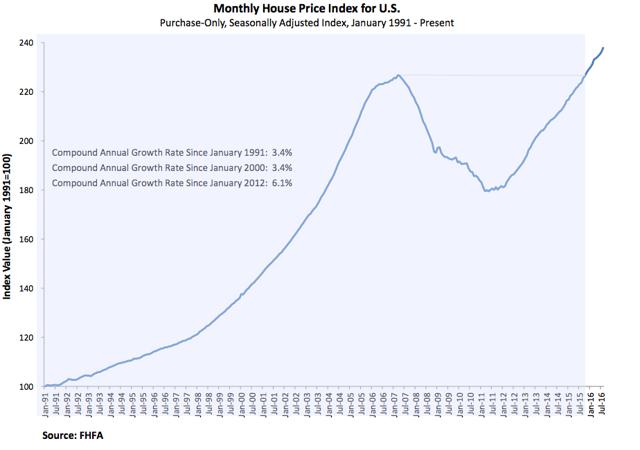

Including the great real estate crash of the financial crisis, single-family houses have appreciated by 3.4% per year in the last +25 years. Some investors will easily beat that, while others will struggle to maintain value. After all, it all comes down to the demand and supply of the specific location and the adequate (or not) maintenance of the property over time. Nonetheless, 3% annual appreciation seems like a reasonable assumption for the average investor who buys in an average market (limited commodity and inflation in replacement cost).

With a 5-10% cash flow yield and 3% appreciation, rental investors may target fairly similar unleveraged total returns as stock investors, but this is before you account for the leverage potential and tax benefits of rental properties.

(2) Buying a Rental Property vs. Stocks – Leverage to Build Wealth

It is simple to get a long-dated fixed rate mortgage with a low interest rate to finance the majority of a rental investment. Rental investors will often use this trick to maximize returns and often use up to 4-to-1 leverage. I have often shared that this may lead to excessive risk taking; but even with a more reasonable 2-to-1 leverage, rental investors can boost returns significantly:

Using back-of-the-napkin level math, if you can finance your rental property at 2-to-1 leverage, pay a 3-4% mortgage rate, and buy an 7-10% yielding property with prospects for 3% annual appreciation, you are set for annual returns that far outperform the stock market indexes. In this particular case, average annual returns would be closer to 15%.

Stock investors can also use margin to leverage their stock investments, but this is much riskier practice because (1) margin debt won’t enjoy the same favorable terms as mortgages, (2) stocks are not as consistent as rentals and (3) the underlying companies are already using debt to finance their operations.

(3) Buying a Rental Property vs. Stocks – Risk

Risk is very subjective, and its assessment will depend from one investor to another. Stock investors will tell you that rental properties require a lot of work, tenants may damage the property, rents will get unpaid, and that you could even get sued.

Rental investors, on the other hand, will tell you that stocks are extremely volatile, that you have zero control, and that you are at the mercy of speculators who dictate the market performance.

My take here is that there is some truth to both of them and that it really comes down to the personal preference of each investor. I would add however that rental investors have two significant advantages over stock investors from a risk perspective:

- Rentals provide very consistent and stable income. Having a roof over your head is a vital necessity, and therefore, rental investors are likely to earn high income even during recessions.

- Rental properties are particularly good hedges against rising inflation. The value of the property is tied to inflation as replacement cost goes up and the rent of the tenant is adjusted upward.

Stocks may also provide these features but commonly to a lesser extent or less directly.

(4) Buying a Rental Property vs. Stocks – Control

One of the biggest reasons for people to invest in rental properties is that you can touch them, feel them, live in them. It is tangible. They want to work on these houses to improve their value and increase rents. In other words, they want to have full control over their investment.

With stocks, you will have to rely more heavily on middlemen and management teams for the day-to-day operation of the business. It creates “principal agent” risk that many feel uncomfortable taking.

On the flip side, this higher control also comes with much greater responsibilities, managerial efforts, and work from the investor. So, it all comes down to what you prefer:

- Earn passive returns but with greater reliance on external parties.

- Be on charge of your own investments, but have to put in more managerial work.

If you have the time, passion, and expertise, you will likely do better by following the latter.

(5) Buying a Rental Property vs. Stocks – Tax Benefits

When it comes to taxes, it is hard to deny that rental properties are more tax efficient than stock investments. Rental investors can take depreciation starting on the first year, and by doing so, they can lower their “income” with a non-cash expense. Moreover, they can also deduct all the other property-related expenses, including interest from their income. Exactly how much a rental investor pays in taxes will depend on a case-by-case basis, but many investors are often able to earn cash flow completely tax-free.

Stock investors won’t enjoy the same advantages of depreciation and may have greater tax burden, but they can also use tax-deferred accounts.

(6) Buying a Rental Property vs. Stocks – Liquidity

Rentals are illiquid. Stocks are liquid. Generally, the liquidity of stocks is a very positive attribute as it makes it easy to BUY and SELL with low transaction cost and efforts. Rental investors will often pay somewhere between 5% and 10% in transaction cost when buying and/or selling their property and need to put “sweat equity” to get a deal done.

Compare this to a few clicks of mouse to invest your money at minimal fees in a regular brokerage account. There is no contest here.

Conclusion: Rental Property vs. Stock Market

Rentals are not for everyone. They require more work and responsibility and are illiquid. However, for the more entrepreneurial investors who are willing to put in the efforts, there is no denying that the prospects to earn higher returns are there.

Of course, it always come down to market valuation and the price that you pay. But assuming that you are in a favorable market where you can buy properties for upwards of 8% cap rates, with value-add opportunities, long-term appreciation and the possibility to finance the deal with 2-to-1 leverage, your returns are likely to far outpace the average stock investor. This won’t come free of work, worries, and risk, but there is significant potential for handy investors.

Source – Seeking Alpha

Contact RPM Central Valley

For more property management tips, or to speak with us about the services we can offer you, contact us today by calling (209) 572-2222 or click here.