How to spot and avoid rental scams

Rental scams are on the rise nationwide and owners are frequently the target of these scams because it’s not uncommon for owners to find out that they’v been scammed until it’s too late.

In this article, we will share with you the top rental market scams so you know what to be on the lookout for at your rental property.

How can you protect your investment from rental scams?

Rental scams can leave a real estate investor out of thousands of dollars in lost rent or property damages. The best line of defense? Landlords need to vet their tenants properly. Seriously, find out as much as you can about the type of person you’re entrusting to live in your investment.

For example, my property management company has put several checks in place to screen applicants. We’ve created a screening matrix to score applicants on factors like credit, income, past rental history, and past due balances.

With years of experience, our team created this matrix as a scoring system to assess risk. Applicants receive a “score” between 0.00 to 6.25 or higher (the lower, the better):

- 0.00 – 3.50 Low Risk (Security Deposit = 1-month rent or 1-month surety bond)

- 3.75 – 5.00 Average Risk (Security Deposit = 1-month rent or 2-month surety bond)

- 5.25 – 6.00 Higher Risk (Security Deposit = 3-month rent or 3-month surety bond)

- 6.25 + Denied or co-signer required

This matrix gives us a quick objective way to review applicants, but as you’ll see below, it’s by no means foolproof. So you’ll need to get your private investigator hat and magnifying glass out.

Who commits fraud and why?

The reasons for committing fraud vary as much as the people committing the crime. Some can’t afford the rent, some have no intention of paying rent, and others want to hide previous financial transgressions.

Today, nearly everyone can alter copies of “official documents” with their phones. Sometimes, you have to dig deeper to uncover the scam.

Don’t get me wrong; we don’t always assume everyone’s out to pull one over on our clients. But if someone has nothing to hide, they shouldn’t get defensive when you start asking questions.

By the way, if someone does get defensive, take that as a red flag and consider denying their application.

But if the numbers don’t add up, addresses don’t check out, or social media profiles suggest someone very different, ask why.

Detecting fraudulent pay stubs

Again, most applicants are honest potential tenants who want to rent your property and pay rent appropriately. However, those few bad apples mean you have to keep your guard up.

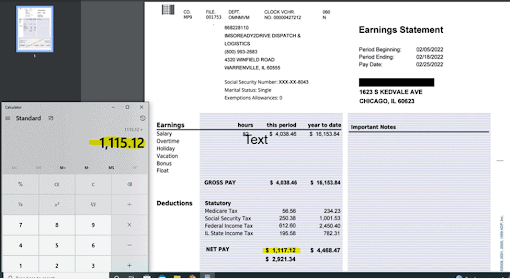

When an applicant submits their proof of income, especially pay stubs, pay close attention to the deductions and watermarks. Look to see if check numbers match pay stubs, too.

Here’s a recent example of a fraudulent pay stub my company received (names have been altered for privacy):

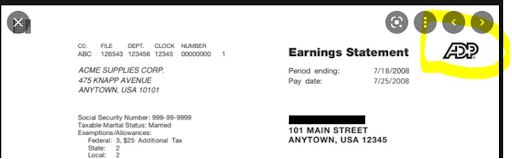

You’ll see that the deductions on the paystub didn’t add up correctly. Also, if you look closely on the right side of the check, it says “ADP”. However, there is no ADP logo at the top of the paystub. Most ADP checks show the logo.

Does that make your Spidey Sense tingle? It should! Time to get out that magnifying glass, better known as Google, to learn more about the applicant’s employer.

If a quick search doesn’t turn up the supposed employer or if an elderly person answers the “business” phone confused about why you’re calling, get suspicious. Sometimes when you ask for additional documentation like a W-2, the scammer knows you’re onto them, and they vanish. Consider yourself lucky for having dodged a bullet.

Identifying fraudulent documentation

Even when someone submits documentation with tax IDs or supervisor information, I recommend you confirm everything. We’ll see applicants claiming to have worked for a place for five years. We discovered that the “company” only filed for an LLC four months ago upon further research. Hmmm, something doesn’t add up.

Things can get weird when a fraudulent application gets submitted on behalf of a totally different person. Use court records to verify a lot of information that’s submitted. These records can provide tons of info (from traffic tickets to divorce proceedings to address discrepancies).

Credit checks can unearth curiosities like mortgages in other towns or signatures on deeds that don’t match application signatures. Again, live by the motto: trust but verify.

Contact Us

At RPM Central Valley, our experienced property management team will protect you from rental scams so that you can have peace of mind in knowing that your rental property will be professionally managed for top dollar.

To learn more about the property management services we can offer you, contact us today by calling (209) 572-2222, or click here to connect with us online.